The common question when it comes to retirement is ‘how much is enough?’.

If only the answer was simple! But the fact is that the answer varies due to a range of factors, including your lifestyle aspirations, personal health and family commitments. But regardless of how much you have put aside, there’s a significant potential cost in retirement that is often not considered, and if ignored, it can undermine our plans - aged care.

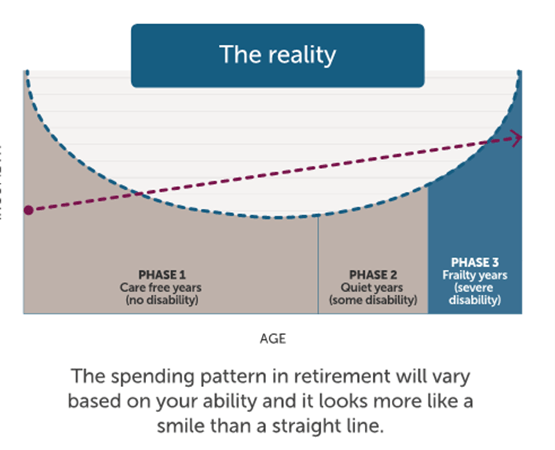

None of us want to imagine a time when we are no longer able to look after ourselves without assistance. But the reality is that around one quarter of our retirement may be ‘frailty years’, where help is needed with the activities of daily living. Planning ahead for this time allows you to maintain greater control of your life, so that your choices – for example, home care versus residential care – can be respected. But it all costs money.

While lifestyle spending does tend to reduce as we progress through retirement, expenses can ramp up again during the “frailty” years – on average, the last three to five years of life, generally after age 80. It is during this phase that we are likely to have some form of disability caused by ageing which causes a general decline in independence. And we may become more reliant on others.

Increasing longevity and expectations around the quality of care are also putting greater pressure on income needs in the later phase of retirement.

Because aged care is expensive, the government subsidises the costs, but you will still need to pay some of the costs – based on your assessed level of affordability. Access to capital or income at this time may allow you to have greater choices and control over the quality of your care, which is why planning for the cost of future care is critical to include in your retirement planning, and long before a crisis arises.

If you want to discuss your future care needs and costs, make an appointment with us today, to learn more about how we can help you to maintain greater control and independence as you age.

Factual Advice Warning: Any information provided in this website is purely factual in nature and does not take into account your personal objectives, situation or needs. The information is objectively ascertainable and is not intended to imply any recommendation or opinion. This does not constitute financial product advice under the Corporations Act 2001 (Cth).