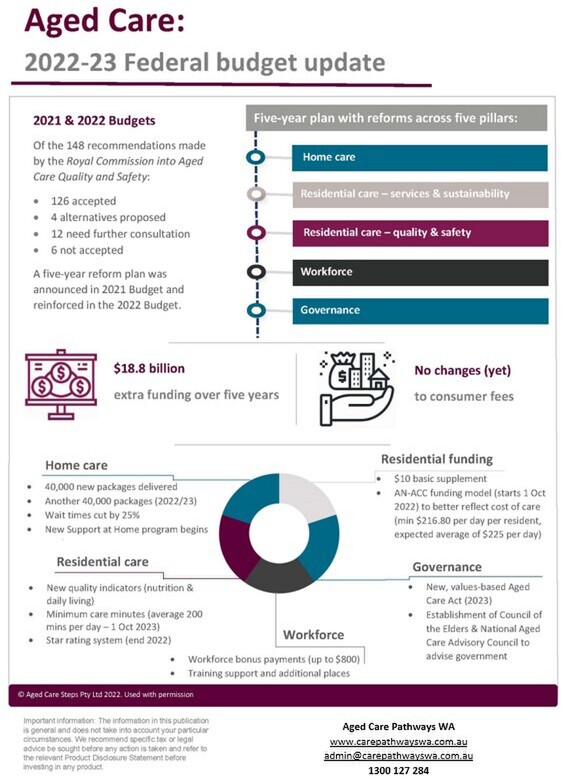

In last year’s Federal Budget we saw a major five-year restructure plan for aged care, so it was not surprising to see no major changes this year. Instead, the government reconfirmed its commitment to the five-year plan. This article takes a quick look at the implications of this year’s Budget for aged care.

Two major challenges for aged care are sufficient funding and adequate staffing – both are challenges compounded by an ageing Australian population and an increasing number of people needing to access aged care services.

Home care implications

Demand for home care continues to increase, and the next tranche of 40,000 new home care packages (to be released over 2022-23) will continue to increase availability and reduce waiting times. Although, the reality is that waiting time for a Level 3 or 4 package is still estimated to be 6-9 months.

Navigating home care should be easier when the current Commonwealth Home Support Program (CHSP) and Home Care Packages are combined into one new Support at Home Program from 1 July 2023. Details are yet to be developed, with advisory committees and older Australians providing input into the development.

Residential care implications

In residential aged care, concerns around adequate funding levels continue to dominate discussions. Last year the Government introduced an additional supplement of $10 per day per resident to help care providers improve services, but cost pressures and demand for higher wages continue to place pressure on care providers.

A new funding model to reset the cost of care for residents is currently being trialled, with implementation set for later this year. This is expected to provide an extra $20.1 million in funding over the next three years. While this boost is welcomed, most industry commentators suggest it is still inadequate to lift standards to meet consumer expectations. It is likely that at some future point, consumer contributions will need to be increased to help cover costs.

Other measures

Retirees may also benefit in the future from other changes proposed in the Budget which included:

- An increase in the low and middle income tax offset (LMITO) for 2021-22 to help with the increase in cost of living

- A six-month reduction in fuel excise to take pressure off fuel prices

- The 50% reduction in minimum payments from an account-based pension to continue for 2022-23

- A one-off $250 payment for recipients of Centrelink/Veterans’ Affairs income support payments and the Commonwealth Seniors Health Card holders.

The aged care reforms should encourage innovation and a wider range of care choices. But these choices are likely to come at a higher cost. As a future user of aged care services it is important to think about what is important to you and start the frailty planning conversation.

We have helped many clients to navigate through the aged care system, providing our clients with peace of mind and a clearer direction on the potential options for structuring finances. Call us today on 1300 127 284 and arrange an appointment to discuss how we can help you and your family.

Factual Advice Warning: Any information provided in this website is purely factual in nature and does not take into account your personal objectives, situation or needs. The information is objectively ascertainable and is not intended to imply any recommendation or opinion. This does not constitute financial product advice under the Corporations Act 2001 (Cth).